The Green Global Breadbasket: Why Brazilian Agribusiness is the Ultimate Frontier for Smart, Sustainable Capital

Introduction – Global Food Security Depends on Brazil

The world’s population is on track to reach nearly 10 billion people by 2050, driving a dramatic increase in food production. However, available arable land is becoming increasingly scarce and degraded on a global scale, up to 40% of land already suffers some level of degradation according to the FAO. In this challenging context, Brazil emerges as a key piece of global food security. Brazil, known as the “breadbasket of the world,” possesses abundant land, fresh water, and a favorable tropical climate, enabling bountiful and diverse harvests. It’s no coincidence that Brazil is already a leader in food production and exports: it is the world’s largest exporter of beef, sugar, coffee, orange juice, poultry, and soybeans, among other products, supplying more than 160 countries with rigorous standards of quality and sustainability. In 2024, for example, Brazilian agribusiness exports reached US$164.4 billion (49% of the country’s total exports), consolidating Brazil as one of the pillars of global supply. With record harvests expected and expansion into new markets, Brazil reinforces its role as a guarantor of global food security by competitively meeting the growing demand for food. In sum, investing in Brazilian agribusiness is investing in the future of world food, uniting economic opportunity with planetary responsibility.

“Inside the Farm Gate” – The Miracle of Tropical Productivity

Behind the success of Brazilian agriculture lies a true miracle of tropical productivity, driven by on-farm (“inside the gate”) technology and innovation. Contrary to what many imagine, the growth of production in Brazil was not based primarily on opening new areas, but on extraordinary yield gains per hectare. One remarkable example is the concept of the “Safra and Safrinha” (main harvest and second harvest): thanks to the tropical climate and advanced techniques, producers manage to harvest two and even three crops on the same land within a single agricultural year, something impractical in much of the temperate U.S. or Europe. Today, a considerable portion of Brazil’s cultivated area employs some form of double cropping, such as soy followed by a second corn harvest (“safrinha”). A large part of the soybean area is immediately sown with corn after the soy harvest, exponentially increasing annual output. Importantly, these advances came with leaps in productivity, reflecting genetic improvements and better management.

Much of this progress is due to Brazilian tropical science, led by Embrapa (the Brazilian Agricultural Research Corporation). Since its founding in 1973, Embrapa has developed crop varieties adapted to the tropics and techniques like no-till farming (which conserves soil) and biological nitrogen fixation, among many other innovations. A recent NBER study confirmed that Embrapa’s public research has boosted national agricultural productivity by an impressive 110% since 1970. In other words, Brazil today produces more than double what it would have without these advances. This technological leap nicknamed the “Land-Sparing Effect,” has been recognized by the FAO and Ipea, showing that increased efficiency allowed meeting growing demand without expanding cultivated area. Modern practices such as precision agriculture, bio-inputs, tropical genetic improvement, and Crop-Livestock-Forest Integration (ILPF) have become common, resulting in constant yield gains. Brazilian farmers have widely adopted sustainable techniques; for example, the Brazilian No-Till Farming Federation (Febrapdp) aims to have 75% of agricultural land using no-till by 2030, which preserves soil moisture and health. In summary, the Brazilian tropical revolution proves that it is possible to expand agricultural production through science and management, not deforestation. The result is an efficient, competitive, and increasingly sustainable agribusiness sector, capable of feats like harvesting three crops a year on the same land and breaking production records year after year without advancing onto new land.

The Myth of Destruction vs. The Reality of Preservation

In the international imagination, the myth sometimes persists that Brazilian agribusiness grows at the expense of environmental destruction. The reality, however, is that Brazil has the world’s most rigorous environmental legislation for rural properties, reconciling large-scale production with extensive preservation. The Brazilian Forest Code (Law 12.651/2012) requires every private landowner to preserve between 20% and 80% of their land with native vegetation as a Legal Reserve, depending on the biome. In the Amazon region, 80% of the farm must remain untouched; in the Cerrado (savanna), 35%; and in other regions (Atlantic Forest, Pampas, Caatinga, Pantanal), 20%. In addition, there are Permanent Preservation Areas (APPs), such as riparian forests, hilltops, and springs, that must also be protected. In practice, studies show that on average Brazilian landowners conserve 50% of their property and produce on the other half. Importantly, all this is required without any government financial compensation, unlike countries that subsidize private conservation. It’s not surprising that Brazil leads the global ranking of conservation on private lands, with an estimated 120 million hectares of native vegetation kept intact within farms by producers, an area larger than the territories of France and Germany combined. These 120 million preserved hectares, voluntarily set aside, demonstrate a unique environmental contribution by Brazilian agribusiness.

Image: Nelore cattle grazing in a pasture integrated with forest vegetation. Brazilian producers are increasingly adopting Crop-Livestock-Forest Integration (ILPF) systems, which combine crops, trees, and livestock in the same area, promoting synergy between production and conservation. Source: Minerva Foods.

Far from being an enemy of the forests, Brazil’s modern agribusiness has been part of the environmental solution, investing in sustainability. The adoption of ILPF and innovative agroforestry systems (such as those developed by Preta Terra) allows forests and plantations to coexist – trees provide shade and sequester carbon, improving animal well-being and offsetting livestock emissions. Initiatives like Embrapa’s “Carbon Neutral Beef” label certify beef produced in silvopastoral systems where tree growth neutralizes the herds’ greenhouse gases. Moreover, the livestock sector is transforming: practices such as pasture restoration, rotational grazing, and improved genetics have raised productivity without expanding area. Between 2004 and 2023, for example, Brazil’s beef production grew from about 7.4 to over 10 million tons, while annual deforestation fell from roughly 27,000 to 9,000 hectares. In other words, the last two decades saw less deforestation even as production increased, proving that agriculture and environmental devastation have been decoupled. The Forest Code also created the Rural Environmental Registry (CAR), a mandatory georeferenced record of all rural properties, which facilitates satellite monitoring and enforcement, a transparency tool praised internationally. With technology, strong legislation, and producer commitment, Brazil has been dispelling the myth that producing more means deforesting more. The result is an agribusiness that is increasingly ESG-friendly, where productivity and preservation go hand in hand, making the country a benchmark in aligning agriculture with environmental conservation.

Vertical Expansion – Growing Without Cutting Down Trees

If horizontally Brazil’s agricultural frontier has stabilized due to legal and environmental constraints, the solution is to grow vertically, in other words, to produce more on the same land. Fortunately, Brazil has enormous “vertical” expansion potential thanks to vast areas of underutilized pasture that can be intensified or converted into high-yield cropland without cutting down a single tree. It’s estimated that Brazil has 28 million hectares of degraded pastures with agricultural potential. These areas were deforested in the past and are underused today, representing an extraordinary opportunity for sustainable production growth. To illustrate: Brazil currently cultivates about 84 million ha with grains/fiber crops; if we add 28 million ha of converted pasture (keeping the two-crops-per-year model in much of it), it’s possible to increase our productive capacity by over 30% without clearing a single hectare of forest.

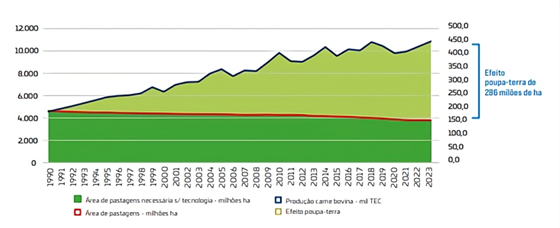

Chart: Evolution of pasture area and beef production in Brazil (1990–2023). The dark green line (at the bottom) shows the utilized pasture area, which remained stable or even declined slightly even as production increased. The light green area represents the “spared area” due to productivity gains – about 286 million hectares that would have been required if technology had stayed at early-1990s levels, highlighting the huge land-sparing effect of intensification. Source: ABIEC.

The intensification of cattle ranching has already shown impressive results: thanks to genetic, nutritional, and management improvements, the stocking rate (cattle per hectare) has tripled on modernized farms, boosting meat production without area expansion. A study by the Brazilian Beef Exporters Association (ABIEC) revealed that if 76% of Brazilian cattle farms (currently below the national average productivity) adopt the technological level of top farms, Brazil alone could supply 68% of the world’s beef demand without expanding any area. This demonstrates the enormous productive upside we can still capture with investment and modernization. Moreover, converting part of these pastures to cropland (especially grains) would not only increase the supply of food and bioenergy but also reduce pressure for new clearings in sensitive biomes, ensuring supply chains 100% free of deforestation. Many global players have already committed to zero deforestation in their supply chains, and Brazil has the chance to be the world’s great deforestation-free supplier by concentrating expansion on already anthropized (previously altered) lands. Growing without cutting down trees has gone from just a concept to becoming state policy and a business strategy, after all, sustainability and productivity walk together in the agribusiness of the future.

Exponential Potential: Scale, Innovation, and Accelerated Returns for Foreign Investors

Given all this, Brazilian agribusiness stands out as an exponential investment opportunity, a final frontier where smart, sustainable capital can thrive. Few places in the world simultaneously offer available scale, global need for food, and openness to innovation. The combination of 28 million additional hectares coming into production with no new deforestation, and heated international demand, creates a unique growth opportunity. To give an idea: China and other Asian countries continue to increase imports of Brazilian grain and protein to ensure their food security. The U.S. and Europe also depend on Brazil for strategic commodities, and with geopolitical instability in other sourcing regions, this dependence tends to grow. The world is counting on Brazil to deliver this productive leap, and there is room for investors to actively participate in this green expansion.

But it’s not just about land and volumes, innovation is the catalyst of this new cycle. Brazil’s agritech ecosystem is buzzing: drones monitoring fields, real-time soil sensors, blockchain guaranteeing traceability and certifying “zero deforestation” products, artificial intelligence optimizing planting and harvesting. From 2017 to 2022, the number of agtech startups in the country more than doubled, and major Silicon Valley and European players are already investing in tropical agricultural solutions. According to the GS1 Brasil AgTech index, the last 5 years saw a 35% jump in the adoption of automation, remote monitoring, and precision control technologies on Brazilian farms, including in livestock. This translates to increasing efficiency and traceability, factors ever more valued by importing markets. The EU, for example, approved regulations requiring proof of zero deforestation in supply chains. Brazilian digital tools already enable tracing the origin of soy or beef from pasture to shelf, meeting these requirements and adding value to products.

From a financial standpoint, the environment has also become more friendly and innovative for foreign investors. Recent measures, such as the Agro Law (13.986/2020) and Law 14.130/2021, modernized rural financing rules, allowing, for instance, the issuance of asset-backed securities (CRA, CDCA) indexed to foreign currency, and enabled the creation of FIAGROs (Investment Funds in Agribusiness Chains). These financial vehicles facilitate the entry of foreign capital into Brazilian agribusiness, including with favorable tax treatment and the possibility for foreigners to hold shares in funds that invest directly in land and rural assets. In other words, today a global investor can access Brazil’s farmland market indirectly via funds, bypassing bureaucratic hurdles while benefiting from asset appreciation. Success cases are already emerging: joint ventures between Brazilian and foreign groups to develop new agricultural frontiers; private equity funds acquiring and consolidating ethanol plants or food processing facilities; and even international partnerships in high-value crop farms (such as tropical fruits and commercial forests for carbon credits).

Add to this government sustainability incentives like the ABC+ Program (Low Carbon Agriculture), which offers subsidized credit for projects integrating ILPF, biological nitrogen fixation, pasture recovery, and renewable energy on farms. “Green” investors can ride this wave by tapping global ESG funds and directing them to projects in Brazil that meet both climate goals and profitability targets. The potential for accelerated returns is notable: those who enter now into pasture conversion or agricultural greenfields will see land appreciate as it becomes productive, in addition to reaping growing revenues from higher productivity and commodity prices. OECD/FAO projections indicate that Latin America, led by Brazil, will account for a large share of the increase in global food supply over the next decade. Brazil, alongside the U.S., is expected to represent 20% of world meat exports by 2033, besides maintaining leadership in grains, sugar, coffee, orange juice, among others. In other words, those investing now in Brazilian agribusiness will be positioned at the nerve center of the global food system, harvesting the fruits of growth driven by fertile land + technology, and strong demand.

In sum, Brazilian agribusiness offers scale in hectares, cutting-edge science, and guaranteed demand, ingredients for accelerated returns, especially for patient capital with a long-term view. And all this aligned with sustainability, an indispensable attribute in the 21st century. It is the ultimate frontier for smart capital because it combines profit and purpose: feeding the planet sustainably while generating wealth for stakeholders.

The Business Landscape – M&A and Industry Consolidation

Opportunities reside not only in the production field. In the business landscape, Brazilian agribusiness is at an evolutionary stage that favors M&A (mergers and acquisitions) and consolidation. Unlike more mature agricultural markets (like the U.S. or Europe) where large corporations dominate production, in some areas of Brazilian agribusiness a fragmented, scattered structure still prevails. For example, there are over 5 million rural properties spread across the country, many of them medium-sized family businesses. This fragmentation means there are relatively few consolidated “national champions” given the sector’s size, which opens space for “buy-and-build” strategies, acquiring multiple smaller operations and unifying them into efficient, scalable platforms.

One driver of this movement is the issue of family succession. Brazilian agribusiness boomed in the 1970s–2000s with pioneers opening new frontiers (especially in the Center-West and MATOPIBA regions). Today, many of those rural entrepreneurs are retiring or looking for successors, but the new generations don’t always want to or can run the business under the same model. Thus, there are families looking to sell or bring in strategic partners to professionalize the management of their farms, mills, or agribusinesses. Foreign investors or domestic funds become ideal partners in these cases, providing capital for expansion, governance, and technology, while the former owners reap the rewards of asset appreciation and often stay involved as consultants or minority shareholders.

Professionalization and corporate governance are another value-creation vector. By consolidating multiple properties or companies under one group, it’s possible to implement better management, compliance, and ESG practices, which increases operational efficiency and makes the business more attractive to international markets. We are already seeing movements of Brazilian agricultural companies going public (IPOs on the B3 exchange) and consolidator groups backed by private equity. The entry of institutional capital brings robust financial controls, transparency, and performance targets, elements that typically boost productivity and reduce unit costs.

This promising scenario also offers numerous opportunities beyond the farm gate. Growing agricultural output constantly demands more inputs, services, and new solutions, creating a favorable environment for new companies to set up in Brazil via acquisitions, mergers, strategic partnerships, or for companies already operating in the Brazilian market to seek vertical or horizontal growth organically or through M&A.

The agribusiness sector is undergoing a moment of corporate transformation, moving from a scattered family-based model toward an era of moderate concentration and professional management. Those who get in now have the chance to lead the next growth cycle, building the agribusiness giants of the future and reaping substantial returns in the process.

Logistics and Infrastructure – The Bottleneck that Became an Opportunity

For decades, logistical infrastructure was considered the “Achilles’ heel” of Brazilian agribusiness – the infamous “Custo Brasil” (Brazil Cost) inefficiencies making Brazilian products more expensive. In recent years, however, this bottleneck has been turning into one of the greatest opportunities for competitiveness gains and investment. The expansion and modernization of outbound logistics, roads, ports, railways, and waterways, have reduced costs and opened new, more efficient routes to bring the harvest to the international market. One highlight is the development of the so-called “Arco Norte” (Northern Arc), the logistics corridor through ports in the North and Northeast, which revolutionized the flow of grain exports. Traditionally, soy and corn from central regions (Mato Grosso, for example) traveled thousands of kilometers by truck to ports in the South/Southeast (Santos, Paranaguá), driving up freight costs and clogging highways. Today, thanks to investments in river and ocean ports in the North (Miritituba, Barcarena, Itaqui, etc.) and in railways like the North-South, a large share of the harvest takes the shorter path toward the Atlantic via the Amazon.

Image: Transshipment of grains (soybeans) onto barges on the Madeira River, part of the Arco Norte waterway system. The use of Amazon waterways has become strategic for transporting Brazil’s harvest, moving nearly 50 million tons of soy and corn between January and October 2025 alone. With shorter routes to Europe and Asia, this logistics reduces transit time and cuts transport costs over long distances by up to 50% compared to traditional road transport. Source: Ministry of Ports and Airports.

Recent figures confirm the change: over 37% of Brazil’s soy exports and 41% of its corn already depart via the Arco Norte ports, easing reliance on the South/Southeast ports. This yields dual benefits, economic and environmental, because in addition to cheaper freight (a river barge carries the load of dozens of trucks with lower CO₂ emissions per ton), it decongests highways and cities. Ambitious railway projects are also advancing: the North-South Railway was completed, linking the heart of Brazil to the ports; the planned Ferrogrão line should connect Mato Grosso to Pará; and private regional railways are emerging to connect local production hubs. On the port front, private terminals have multiplied shipping capacity and management has become more agile after regulatory changes increased private sector involvement.

For investors, infrastructure tied to agribusiness is fertile ground for opportunities. Highway concessions, greenfield railway projects, port terminals, and storage facilities are expanding, many with support through incentives (infrastructure debentures, public-private partnerships). Returns can be significant, as demand for transport capacity only grows with record harvests, and each logistics improvement adds value across the agribusiness chain. Investing in agro-logistics infrastructure in Brazil today means capturing the efficiency gains of a gigantic sector that is finally being well-served with paths to market. The bottleneck is turning into a competitive advantage, and as it solves a historical problem, it creates sustainable businesses for those who invest in this transformation.

How to Invest Safely – The Role of Silveira Capital

In the face of so many opportunities, it’s clear that navigating the universe of Brazilian agribusiness requires deep local knowledge. Brazil is a land of immense potential, but also of regulatory, environmental, and cultural complexities. For foreign investors (and even domestic ones) who want to enter this market with peace of mind, having a specialized partner makes all the difference. It is in this context that Silveira Capital positions itself: combining field and financial expertise, we act as a safe bridge between capital and high-quality agribusiness projects.

Investing in Brazil’s agribusiness goes beyond traditional financial analysis, it involves understanding land titles, environmental compliance, land tenure situation, climate, regional logistics chains, among other peculiar factors. Risk mitigation is a central part of our work. With our 360° approach, the investor can enter confidently, knowing that all angles have been considered.

Another differentiator of Silveira Capital is the ability to originate off-market opportunities, outside the common radar. Thanks to our direct relationships with producers, cooperatives, and industry entrepreneurs, we access exclusive assets. This allows us to craft tailor-made deals for each investor’s objectives, often under more favorable conditions than auctions or public offerings. We structure everything from green joint ventures (where the investor contributes capital for expansion and the local partner provides know-how and management) to full mergers/acquisitions, handling all negotiations and the most efficient legal/tax structuring.

In short, Silveira Capital offers end-to-end support: from the initial strategic planning to a successful exit down the road, maximizing returns and minimizing hurdles. Our mission is to make investing in Brazilian agribusiness a safe, profitable, and straightforward journey for our clients, turning the enormous potential highlighted throughout this article into tangible reality in their portfolios.

Conclusion – An Invitation to the Future

We have seen that associating Brazilian agribusiness with deforestation is a mistake. Unlike much of the world, Brazil’s rural producers preserve areas that, together, exceed the territories of France and Germany. It is not fair, therefore, that environmental crimes be attributed to those who produce responsibly. Conscious investment in the sector can yield excellent results and incentivize conservation, as long as there is a clear distinction between legal and illegal activity.

Brazilian agribusiness presents itself as a unique frontier where purpose and profit align. Investing in Brazil’s agribusiness means sustainably feeding the planet, helping to ensure global food security and environmental preservation, while reaping solid financial returns in a continuously expanding sector. Few investment opportunities in the world today offer this rare combination of scale, innovation, and positive impact.

Brazil, the land of the green breadbasket, has shown that it is possible to produce more using fewer resources and respecting the environment. In the coming years, we will see ever larger harvests coming from the same areas, thanks to tropical science; we will see entire supply chains free of deforestation and certified sustainable; we will see Brazil consolidating its position as the #1 provider of food and bioenergy for a world that is clamoring for green solutions. Those who join this journey now will not only have a first mover advantage, but will also be actively contributing to a better future, one where investing and doing the right thing go hand in hand.

Here is the invitation to the future: Silveira Capital is at your disposal to guide you on this promising path. Whether you are an international investor seeking new frontiers of growth, or a visionary Brazilian who sees the value of Brazil’s agribusiness, we are ready to hear your goals and present the most suitable opportunities. Let’s talk about how your capital can flourish in Brazil’s fertile soil. The next chapter of agricultural history is being written now, and you are our special guest to harvest it together. Get in touch and come be part of this sustainable and profitable revolution. After all, investing in Brazilian agribusiness is investing in the future of the planet. We are ready to build success stories by your side that will feed the world and generate prosperity. Let’s move forward!

Silveira Capital – connecting opportunities and capital.

About the Author

Jéferson Silveira Martins is a specialist in Mergers and Acquisitions (M&A), business development, and investment fundraising in the agribusiness and mining sectors. As the founder of Silveira Capital, he leads strategic transactions, connecting investors to solid opportunities.

Learn more about Jéferson Silveira Martins and his journey here: Jéferson Silveira Martins Biography

Legal Notice: This article is provided for informational purposes only and does not constitute legal, financial, or investment advice. Before making any investment or divestment decision, consult qualified professionals. The opinions expressed in this article are the author’s and do not necessarily reflect those of Silveira Capital or its affiliates.