Valuation: Understanding the Fundamentals, Methodologies, and Applications

Introduction to Valuation

Valuation is the cornerstone of finance, providing a systematic method to determine the value of a business, project, asset, or company. It is essential for making informed decisions in investments, divestment, mergers, acquisitions, and strategic planning. Whether one is an entrepreneur assessing the worth of a startup, an investor deciding on potential acquisitions, or a corporation seeking funding, understanding valuation is a critical skill.

Key Concepts in Valuation

Intrinsic Value: Coined by Benjamin Graham and popularized by Warren Buffett, intrinsic value represents the true worth of an asset based on its fundamentals. It differs from market price, which can be influenced by sentiment and short-term factors.

Market Value: The price at which an asset or company would trade in the open market. Market value often fluctuates due to external factors, including economic conditions and investor behavior.

Enterprise Value: A measure of a company's total value, including equity and debt, and is often used in mergers and acquisitions.

Importance of Valuation

Valuation informs various financial and strategic decisions:

Investment Decisions: By understanding the intrinsic value of an asset, investors can identify undervalued or overvalued opportunities.

Business Strategy: It aids in setting realistic goals, whether for capital raising, partnership negotiations, or divestitures.

M&A Activity: Valuation is vital in negotiating deal terms, setting transaction prices, and identifying synergies.

Contributions of Valuation Experts

Aswath Damodaran: Known as the "Dean of Valuation," Damodaran has contributed extensively to the understanding of valuation methodologies. His works, including Investment Valuation and The Little Book of Valuation, provide practical insights into valuation practices for businesses across industries.

Richard Brealey: Co-author of Principles of Corporate Finance, Brealey has been instrumental in connecting valuation with broader financial principles, offering a comprehensive understanding of financial strategy.

Benjamin Graham, often referred to as the "Father of Value Investing," laid the foundation for modern investment and valuation practices. His seminal works, Security Analysis (co-authored with David Dodd) and The Intelligent Investor, revolutionized the way investors assess the intrinsic value of assets. Graham introduced the concept of intrinsic value—the actual worth of a stock or company based on fundamental analysis rather than market sentiment.

Why Valuation Matters

For businesses navigating competitive and volatile markets, valuation serves as both a compass and a tool:

- Entrepreneurs use it to attract investors.

- Corporations rely on it for financial reporting and strategic growth.

- Investors and analysts depend on it to assess market opportunities.

Introduction to the Article

Valuation is a critical element in finance, serving as the backbone for informed decision-making across investments, business strategies, and mergers and acquisitions. In this article, we delve into the fundamental concepts, methodologies, and applications of valuation, offering a comprehensive guide for businesses, investors, and financial professionals.

What to Expect in This Article

The Foundations of Valuation:

- An exploration of valuation’s importance in understanding intrinsic and market value.

- Key concepts like enterprise value and financial strategy.

- Insights from experts such as Benjamin Graham, Aswath Damodaran, and Richard Brealey.

Valuation Methodologies:

- Detailed breakdowns of approaches, including the income, market, and asset-based methods.

- Real-world examples to illustrate each technique.

The Difference Between Pricing and Valuation:

- An analysis of how pricing and valuation differ in purpose and execution.

- Examples of when and why each is used.

Practical Applications and Challenges:

- How valuation is applied in M&A, strategic planning, and investment decisions.

- Common pitfalls and how to avoid them.

Case Studies and Examples:

- Examination of real-world scenarios where valuation played a pivotal role.

- Examples from diverse industries to illustrate its versatility.

Emerging Trends in Valuation:

- The impact of global economic shifts, ESG considerations, and technology on valuation practices.

- How businesses can adapt to these evolving dynamics.

This article is designed to be both educational and actionable, equipping readers with the knowledge and tools to apply valuation principles effectively. Whether you are an investor evaluating opportunities, a business owner preparing for a sale, or a professional in the financial sector, this guide will help you navigate the complexities of valuation with confidence.

Relevance to Silveira Capital

At Silveira Capital, valuation underpins our approach to helping clients make informed decisions. Whether you're considering a merger, acquisition, disinvestment or new investment, our expertise ensures accurate and actionable valuation insights tailored to your needs.

Valuation vs. Pricing

Valuation and Pricing: Understanding the Core Differences

Valuation and pricing are often used interchangeably, but they represent fundamentally different concepts in finance. While valuation focuses on determining the intrinsic value of an asset based on its fundamentals, pricing revolves around understanding the market value, which is influenced by external factors like supply, demand, and investor psychology.

The Core Distinction

Valuation is a methodical process aimed at identifying an asset’s true worth based on objective data such as cash flows, growth rates, and risk factors. In contrast, pricing reflects the number at which buyers and sellers are willing to transact in the market. This number often deviates from intrinsic value due to factors like market sentiment, speculation, and behavioral biases.

Renowned valuation expert Aswath Damodaran, in The Little Book of Valuation, highlights this dichotomy: "Pricing is driven by market mood, momentum, and the herd, while valuation is driven by fundamentals and a search for value."

How Market Sentiment Influences Pricing

Market sentiment plays a pivotal role in pricing. Factors like economic news, geopolitical events, and market psychology can cause substantial price fluctuations, sometimes detaching the price from the asset’s intrinsic value. For instance:

Investor Herd Mentality: During market booms, speculative buying often drives prices higher than justified by fundamentals. The 2008 housing bubble exemplifies this, where real estate prices soared far beyond their intrinsic value due to irrational exuberance.

Behavioral Biases: Concepts such as loss aversion and overconfidence frequently lead to pricing anomalies, as explored by behavioral economists like Daniel Kahneman.

The Role of Intrinsic Value in Valuation

Valuation, on the other hand, seeks to cut through the noise of market sentiment to provide a grounded estimate of value. For example, in value investing, popularized by Benjamin Graham, investors look for assets trading below their intrinsic value to capitalize on mispricings. Graham’s principles laid the foundation for legendary investors like Warren Buffett, who famously said, “Price is what you pay, value is what you get.”

Examples of Pricing vs. Valuation in Action

The Dot-Com Bubble (1999-2000): Pricing Driven by Market Euphoria

During the late 1990s, the dot-com bubble illustrated a striking divergence between pricing and valuation. Investors heavily bid up the prices of internet-related companies, such as Pets.com, despite the lack of sustainable business models or profitability. The market price of these companies was driven by speculation, momentum, and the fear of missing out, rather than intrinsic value.

Valuation Perspective: Based on fundamentals, many of these companies had minimal revenues and no clear path to profitability. Valuation analyses would have revealed that their intrinsic value was far below their market price.

Outcome: When market sentiment shifted, the bubble burst, and prices collapsed. This highlighted the importance of understanding valuation over speculative pricing. Companies like Amazon, which were undervalued at the time relative to their potential, eventually emerged as winners.

Berkshire Hathaway: Valuation Anchored in Fundamentals

Warren Buffett’s Berkshire Hathaway provides an example of disciplined valuation-driven investing. Buffett avoids overpaying for assets and emphasizes intrinsic value by focusing on companies with strong cash flows, competitive advantages, and long-term growth potential.

Valuation Perspective: The company consistently evaluates assets using intrinsic value calculations and a safety margin, ensuring investments are purchased below their estimated worth.

Market Pricing Alignment: Over time, market prices have tended to align with or exceed the intrinsic value of Berkshire’s holdings, delivering steady returns to investors.

Key Takeaways

These examples demonstrate the dynamic tension between pricing and valuation:

Market Sentiment and Speculation: Pricing often reflects emotional and external factors that deviate from fundamentals, as seen in the dot-com bubble and Tesla.

Long-Term Alignment: Over time, pricing often converges with intrinsic value, creating opportunities for disciplined investors, as seen in Apple’s turnaround and energy stocks during the pandemic.

Role of Expertise: Understanding the difference between pricing and valuation is essential for making informed decisions. Tools like DCF models and knowledge of behavioral finance, as emphasized by Aswath Damodaran, are invaluable in navigating this landscape.

Practical Implications for Businesses and Investors

For businesses, understanding the difference between valuation and pricing is critical. A company preparing for an IPO needs a robust valuation framework to attract informed investors, even if the market price fluctuates after listing. Investors, too, benefit from separating valuation from pricing, as it helps them avoid overpaying for assets influenced by speculative markets.

Why This Matters for You

At Silveira Capital, we specialize in bridging the gap between intrinsic value and market price. Whether you're a business owner preparing for a transaction or an investor seeking undervalued opportunities, our expertise ensures that your decisions are based on solid valuation principles rather than transient market dynamics.

For further insights, explore Aswath Damodaran’s work on valuation in The Little Book of Valuation or contact Silveira Capital for tailored financial strategies. Learn how our methodologies can help navigate the complexities of valuation and pricing to achieve sustainable financial success.

Common Pricing Approaches and Methodologies

Valuation methodologies are foundational tools for determining the worth of an asset, company, or investment. While valuation focuses on the intrinsic value based on fundamentals, pricing methodologies provide insights into the asset's current market perception. In this chapter, we will explore key approaches to valuation, including the Market Approach, Asset-Based Approach, and Multiples, along with other methodologies. These strategies play a pivotal role in financial analysis, mergers and acquisitions, and investment decisions.

Market Approach

The Market Approach determines value by comparing the target asset or company to similar entities in the market. It primarily relies on Comparable Company Analysis (CCA) and Precedent Transactions.

Comparable Company Analysis (CCA)

Definition: This method evaluates a company by comparing it to publicly traded peers based on metrics like revenue, EBITDA, and market capitalization.

Application: Used frequently in mergers and acquisitions to set benchmarks for valuation.

Limitations: CCA depends on finding truly comparable entities. Market fluctuations or lack of direct peers can skew results.

Precedent Transactions

Definition: Examines valuation metrics from recent transactions involving similar companies or assets.

Application: Used in M&A to estimate transaction premiums and establish fair market value.

Limitations: Market conditions during past transactions may differ from current circumstances, affecting relevance.

Reference: Aswath Damodaran emphasizes in Investment Valuation that the Market Approach is effective for industries with standardized metrics and abundant data but warns against over-reliance on historical multiples.

Asset-Based Approach

The Asset-Based Approach focuses on a company’s tangible and intangible assets to calculate its value. This method is particularly useful for businesses with substantial fixed assets, such as manufacturing or real estate companies.

Net Asset Value (NAV)

Definition: NAV equals the total assets of a company minus its liabilities. This is used for both liquidation scenarios and going-concern valuations.

Applications:

Liquidation Value: Determines value if a company’s assets are sold piecemeal.

Going-Concern Value: Evaluates asset worth assuming continued business operation.

Limitations: NAV overlooks potential growth and synergies, making it less suitable for high-growth industries like technology.

Reference: Shannon Pratt, in Business Valuation: Discounts and Premiums, highlights NAV as a strong method for valuing asset-intensive industries but notes its limited scope for dynamic sectors.

Multiples

Multiples-based valuation is one of the most common approaches to estimate the value of a company. It uses ratios derived from financial metrics.

Types of Multiples

EV/EBITDA (Enterprise Value to EBITDA): Popular for comparing profitability across companies with varying capital structures.

Price-to-Earnings (P/E) Ratio: Commonly used for publicly traded stocks to compare earnings relative to price.

Price-to-Sales (P/S) Ratio: Useful for early-stage companies with minimal profits but significant revenue growth.

Example Application

Tech Startups: Often valued using P/S ratios due to high revenue potential but low current profits.

Limitations: Multiples can vary widely across industries, making cross-sector comparisons challenging.

Reference: Tim Koller and team, in Valuation: Measuring and Managing the Value of Companies, stress the importance of industry-specific multiples for meaningful insights.

Key Takeaways

Market Approach is ideal for data-rich industries with standardized benchmarks but can be skewed by unique market conditions.

Asset-Based Approach suits asset-heavy businesses, offering a clear snapshot of tangible value but lacking growth considerations.

Multiples are versatile but require careful industry-specific application to avoid misleading conclusions.

For businesses and investors, understanding these approaches ensures informed decisions based on intrinsic and market-driven values. At Silveira Capital, we integrate these methodologies into tailored valuation strategies, helping clients navigate complexities with confidence.

For further reading: Explore Aswath Damodaran’s The Little Book of Valuation and McKinsey’s Valuation: Measuring and Managing the Value of Companies.

Valuation Methodologies for Mining Projects

We could not fail to mention the valuation methods used in mining, one of Silveira Capital's markets of operation. The economic valuation of mining projects is a critical process for investors, operators, and other stakeholders. This process involves selecting appropriate methodologies that consider the project's development stage, the level of geological knowledge available, and the specific objectives of the valuation, such as acquisition, sale, partnership, or securing financing. This chapter presents the main methodologies used for mining project valuation, their applications, advantages, and disadvantages, as well as guidance on when each method is most appropriate.

Valuation Methodologies

Below, we explore the main approaches used to economically evaluate mining projects:

- Discounted Cash Flow (DCF)

- How it works: Projects the future free cash flow of the mining project (revenues minus operating costs, CAPEX, taxes, etc.) over the mine’s life, discounted at an appropriate discount rate (often the Weighted Average Cost of Capital, WACC).

- When to use:

- Advanced-stage projects (definitive or pre-feasibility study completed).

- Reliable data on costs, production, mine life, and metallurgical recovery is available.

- Advantages:

- Highly detailed and sensitive to economic project conditions.

- Disadvantages:

- Requires precise estimates and can be overly sensitive to assumptions (commodity prices, discount rate, etc.).

- Market Multiples

- Resource and Reserve Multiples

- How it works: Based on the market value of similar projects, often expressed as a value per unit of mineral resource or reserve (e.g., USD/t of ore or USD/oz of gold).

- When to use:

- Intermediate or advanced-stage projects with well-defined resources or reserves.

- When market benchmarks are available.

- Advantages:

- Simple and quick to apply.

- Useful for comparing similar projects within the same commodity.

- Disadvantages:

- Does not reflect project-specific characteristics, such as quality, infrastructure, or location.

- Area Multiples (Price per Acre or km²)

- How it works: Values the project based on the average price paid per unit of area in market transactions.

- When to use:

- Early-stage projects (exploratory).

- When geological potential is unknown but the location or commodity type is promising.

- Advantages:

- Simple and based on historical market data.

- Disadvantages:

- Very generic and reliant on market data to be meaningful.

- Sunken Costs

- How it works: The project value is estimated based on past investments in geological research, drilling, laboratory analysis, and technical studies.

- When to use:

- Early or intermediate-stage projects.

- When past investments provide a good indicator of the project’s potential value.

- Advantages:

- Objective and easy to verify.

- Disadvantages:

- Ignores future potential and may undervalue promising discoveries.

- Precedent Transactions

- How it works: Uses data from recent transactions of similar projects, adjusting for differences in quality, location, and stage.

- When to use:

- All stages, depending on the availability of comparable data.

- Advantages:

- Reflects current market conditions.

- Disadvantages:

- Relies on public or reliable data on comparable transactions.

- Development-Stage Multiples

Greenfield Exploration

- Area multiples or sunken costs.

- Justified by high risk and limited available information.

Brownfield Exploration

- Resource or reserve multiples.

- Justified when initial mineral resource estimates exist.

Pre-Production Stage

- Discounted Cash Flow (DCF).

- Combination of market multiples with preliminary DCF analysis.

Production Stage

- Detailed DCF analysis.

- Precedent transaction analysis.

Summary: Choosing the Right Methodology

|

Project Stage |

Primary Methodology |

Complementary Approach |

|

Initial Exploration |

Area Multiples, Sunken Costs |

Precedent Transactions |

|

Advanced Exploration |

Resource Multiples |

Preliminary DCF |

|

Pre-Production |

Discounted Cash Flow (DCF) |

Market Multiples |

|

Production |

Detailed DCF |

Precedent Transactions |

Conclusion

The valuation of mining projects is inherently complex, requiring a careful balance between technical knowledge, market dynamics, and financial modeling. While each methodology offers distinct insights, combining multiple approaches often yields a more robust evaluation. Properly understanding the project’s development stage and available data is critical to selecting the most appropriate valuation method.

Discounted Cash Flow (DCF) Method

The Discounted Cash Flow (DCF) method is one of the most widely used valuation methodologies, especially in M&A transactions. It provides a structured framework to assess a company’s intrinsic value by estimating its future cash flows and discounting them to the present value. Unlike other approaches, the DCF method is forward-looking, emphasizing a company’s ability to generate future income rather than its current market metrics or asset values.

The Role of DCF in M&A Transactions

In mergers and acquisitions, valuation is the cornerstone of deal structuring, due diligence, and negotiation tactics. The DCF method plays a critical role in identifying the fair value of a target company, enabling buyers and sellers to establish a baseline for negotiations. It also helps incorporate synergies and transaction premiums—two key elements in determining the attractiveness of a deal.

Due Diligence: Accurate cash flow projections depend on a comprehensive understanding of the target company’s financial health, operations, and growth potential. Due diligence ensures that projections align with real-world performance.

Negotiation Tactics: A thorough DCF analysis equips both parties with data-driven insights to advocate for a fair price. For buyers, it prevents overpayment, and for sellers, it ensures their company is not undervalued.

Synergies and Premiums: In M&A, buyers often pay a transaction premium—an amount above the standalone intrinsic value of the company—to account for anticipated synergies. These synergies might include cost savings, increased market share, or revenue enhancements post-acquisition. Factoring these into the DCF analysis adjusts the valuation to reflect the deal's full potential.

Key Steps in the DCF Method

The DCF can be divided in the following steps:

Project Free Cash Flows (FCFs):

Estimate the company’s cash inflows and outflows over a forecast period (typically 5–10 years). Usually, cash flows are projected until the company reaches steady state, the point when the growth is constant.

- Detailed Projection of Cash Flows:

- Revenue, Costs, and Expenses: Cash flow projection begins with estimating revenues based on historical data, industry trends, and market conditions. Costs (fixed and variable) and operating expenses are subtracted to calculate EBIT (Earnings Before Interest and Taxes). These are expenses directly related to the core operations of a company, such as salaries, utilities, rent, raw materials, and logistics. Non-operational Expenses (One-time legal settlements, Interest on debt (for equity valuation, this is excluded and handled in the discount rate) Investment losses or gains from unrelated activities), should not be deducted from the cash flow.

- Depreciation and Amortization: Non-cash expenses like depreciation are deducted to calculate EBIT but added back when computing Free Cash Flow (FCF), as they don’t impact actual cash outflows. Aswath Damodaran, a prominent valuation expert, emphasizes that depreciation should not be subtracted from cash flow in its final form because it is a non-cash expense. Depreciation reflects the gradual reduction in the value of a tangible asset over time, accounting for its usage or obsolescence.

- Taxes: Taxes are calculated on EBIT after adjustments for non-cash expenses, utilizing the company's effective tax rate.

- Capital Expenditures and Working Capital: Investment in fixed assets (CAPEX) and changes in working capital are factored into the cash flow projection, as they directly affect liquidity. While depreciation itself does not affect cash flow, CAPEX (Capital Expenditures) is the mechanism through which the need to replace assets is accounted for in valuation. Depreciation signals the use and wear of assets, implying that a company will need to invest in maintaining or replacing those assets in the future. The timing and magnitude of such replacements are reflected in the CAPEX assumptions of the DCF model.

- Growth in Perpetuity:

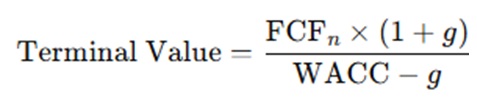

The terminal value is often calculated using the Gordon Growth Model, which assumes a constant growth rate into perpetuity:

The growth rate g should reflect the industry and economic conditions. It cannot exceed the expected long-term growth of the industry or economy, as doing so implies the company will outgrow the market, an unrealistic assumption for sustainable valuation.

Factors like commodity prices, industry cycles, and regulatory conditions are critical in determining an appropriate g.

- Cost of Capital and Risk:

Equity Cost Calculation:

- The Capital Asset Pricing Model (CAPM) is used:

- Rf: Risk-free rate (e.g., government bond yield).

- Rm : Expected market return.

- B: Measures the stock's volatility relative to the market. A levered beta reflects the company’s capital structure (debt and equity). Adjustments to unlevered beta are made when assessing different leverage scenarios.

WACC:

![]()

- WACC includes the weighted average of debt and equity costs:

- Use WACC when valuing the enterprise value (value of debt and equity combined).

- When discounting only to the equity value (after deducting debt), use the Cost of Equity instead of WACC.

Benefits and Limitations of the DCF Method

Benefits:

- Provides a comprehensive view of a company’s potential value based on its future earning capacity.

- Incorporates company-specific factors, making it highly customizable.

- Useful for evaluating long-term investment decisions and M&A transactions.

- Focuses on intrinsic value rather than market sentiment.

- Reflects company-specific fundamentals, such as cash flow potential and industry conditions.

- Allows for sensitivity analysis by adjusting growth rates, discount rates, or other inputs.

Limitations:

- Sensitive to assumptions about cash flows, discount rates, and terminal growth rates.

- Time-intensive and require detailed data.

- May be less reliable for early-stage companies with volatile cash flows or industries with rapid changes.

- Requires significant data and industry knowledge, which can be challenging for volatile or emerging industries.

- May overestimate value if overly optimistic assumptions are made, such as growth rates or cost reductions.

Relevance to Silveira Capital

At Silveira Capital, we specialize in applying robust valuation methodologies like DCF to support clients in M&A transactions, investment decisions, and strategic planning. Whether you're evaluating an acquisition opportunity or negotiating a deal, our expertise ensures that your decisions are grounded in accurate and actionable insights.

References and Further Reading

Aswath Damodaran’s Investment Valuation offers a detailed exploration of DCF techniques and their applications in corporate finance.

Tim Koller, Marc Goedhart, and David Wessels’ Valuation: Measuring and Managing the Value of Companies provides comprehensive insights into DCF and other valuation methodologies.

McKinsey’s Valuation Guide

Damodaran Online offers tools and resources for financial modeling.

By integrating methodologies like DCF with our deep industry expertise, Silveira Capital ensures our clients maximize the value of their strategic decisions in an ever-evolving market landscape.

Common Mistakes in Valuation

Valuation is as much an art as it is a science; Prof. Damodaran call it a craft, and even seasoned professionals can fall prey to common pitfalls. Misjudgments in assumptions, failure to consider risks, or neglecting macroeconomic factors can lead to significant errors, distorting the value of a company or asset.

Aswath Damodaran: In The Dark Side of Valuation, Damodaran emphasizes the dangers of over-optimism in growth projections and the importance of rigorous stress testing.

In this chapter, we highlight these mistakes, provide real-world examples, and offer insights to avoid them.

Over-Reliance on Assumptions

Valuation models often rely on assumptions about growth rates, market conditions, and financial performance. However, overestimating or underestimating these variables can lead to skewed valuations.

Lesson Learned: Conduct scenario analyses and stress testing to understand how variations in key assumptions impact valuation. Use industry benchmarks for realism.

Failure to Adjust for Risk

Ignoring the inherent risks associated with an investment is a frequent error. Valuation models must account for factors such as operational risks, regulatory changes, and market volatility.

Lesson Learned: Employ risk-adjusted discount rates, such as those derived from the Capital Asset Pricing Model (CAPM), and ensure that risk is adequately reflected in cash flow projections.

Ignoring Macroeconomic Factors

Valuation is influenced by broader economic conditions such as interest rates, inflation, and currency fluctuations. Neglecting these can lead to overvaluation or undervaluation.

Lesson Learned: Incorporate macroeconomic indicators into valuations. For instance, rising interest rates should lead to higher discount rates, lowering valuations for interest-sensitive sectors.

Neglecting Synergies in M&A Valuations

When valuing companies for mergers and acquisitions (M&A), synergies play a crucial role. Ignoring or overestimating these synergies can lead to flawed deal valuations.

Lesson Learned: Quantify synergies conservatively and evaluate integration feasibility before including them in valuations.

Overconfidence in Data Precision

Valuation models are only as good as the data they rely on. Overconfidence in historical data or extrapolations can lead to inaccuracies. Valuations in emerging markets often falter because they rely on historical data that may not reflect current economic or regulatory changes.

Lesson Learned: Continuously update data inputs and remain skeptical of extrapolated trends.

Frequently Asked Questions about Valuation

In this chapter, we address some of the most frequently asked questions about valuation to provide clarity on the subject and help you better understand key concepts. Whether you are an investor, business owner, or someone simply looking to dive deeper into valuation, this section will help clear up common doubts.

1. What is Valuation?

Valuation is the process of determining the worth or value of a company, asset, or investment. This process involves analyzing financial performance, market conditions, and other factors to estimate the intrinsic value. Valuation is critical for investment decisions, mergers and acquisitions (M&A), financial reporting, and strategic planning.

Key Concept:

Valuation can be done using different methodologies such as Discounted Cash Flow (DCF).

2. What is the Difference Between Valuation and Pricing?

Valuation refers to determining the intrinsic value of an asset or company, which is based on fundamental analysis such as projected cash flows, risks, and growth potential. Pricing, on the other hand, refers to what the asset or company is actually selling for in the market at a particular point in time. While valuation relies on fundamental data, pricing is influenced by market sentiment, supply and demand, and investor psychology.

Key Concept:

Market prices often fluctuate based on psychological factors and market sentiment, while valuation is driven by long-term, fundamental data and analysis.

3. What Are the Common Methods of Valuation(and pricing)?

The most common methods of valuation include:

- Discounted Cash Flow (DCF): This method projects a company’s future cash flows and discounts them to their present value using an appropriate discount rate, typically the WACC (Weighted Average Cost of Capital).

- Comparable Company Analysis (CCA): This method compares the company being valued with similar companies in the market, using multiples such as the P/E ratio or EV/EBITDA.

- Precedent Transactions: This method looks at past transactions of similar companies to derive a value, using historical transaction multiples as a benchmark.

- Asset-Based Valuation: This method focuses on the net asset value (NAV) of a company’s tangible and intangible assets.

Key Concept:

The choice of methodology depends on the type of business, the purpose of valuation, and available data.

4. How Do You Calculate the Value of a Business?

To calculate the value of a business, you must consider the company’s cash flows, market conditions, and asset base. Here’s a general approach for calculating business value using the Discounted Cash Flow (DCF) method:

- Project the business’s future cash flows over a forecast period (usually 5-10 years).

- Discount these cash flows to present value using an appropriate discount rate (such as the WACC).

- Determine the terminal value, which accounts for the business’s value beyond the forecast period (often using a perpetuity growth method).

- Add the present value of the cash flows and the terminal value to arrive at the business’s total enterprise value.

Key Concept:

Calculating a business's value requires detailed financial forecasting and an understanding of the industry’s long-term trends.

5. Why is Valuation Important for Mergers and Acquisitions (M&A)?

Valuation is a key component of M&A because it determines the worth of a company and helps parties in the deal understand what they are acquiring or selling. It ensures that the transaction is fair and based on an accurate estimate of the company’s true value. Additionally, transaction premiums and synergies are factored into M&A valuations, which can significantly affect the final agreed price.

Key Concept:

M&A valuations help determine the appropriate offer price, identify potential risks, and assess how the deal will create value for both the buyer and the seller.

6. How Do Risk and Beta Affect Valuation?

Risk and beta are crucial in determining the discount rate:

- Beta: Measures a company’s volatility relative to the market. A high beta indicates higher risk and requires a higher discount rate.

- Risk-Adjusted Valuation: Adjusts for uncertainties by incorporating risks into the discount rate or cash flow projections.

- Keywords: beta in valuation, risk-adjusted valuation, company beta.

7. What is the Role of Synergies in M&A Valuations?

Synergies refer to the potential benefits that arise when two companies merge or one company acquires another. These synergies can include cost savings, increased revenue opportunities, and expanded market reach. When valuing an M&A deal, synergies are factored into the overall valuation, adjusting the purchase price to reflect the additional value created from the combination of the two companies.

Key Concept:

Accurately estimating synergies is critical for determining whether the acquisition or merger is worth pursuing. If synergies are overestimated, it can lead to overvaluation.

8. What Are Some Common Mistakes in Valuation?

Some common mistakes in valuation include:

- Over-reliance on assumptions: Valuation models are only as good as the assumptions they are based on. Using overly optimistic growth rates or ignoring risk can lead to significant overvaluation.

- Ignoring macroeconomic factors: Failing to account for interest rates, inflation, or other economic factors can distort the valuation.

- Underestimating risk: Not adjusting for risk, particularly in volatile industries, can lead to overly high valuations.

Key Concept:

Valuation is not a precise science; it requires a balanced approach, taking into account various factors, including assumptions, risks, and market conditions.

9. How Can Silveira Capital Help with Valuation?

Silveira Capital offers expertise in business valuation, M&A advisory, and strategic financial planning. We combine advanced methodologies with market insights to deliver accurate and actionable valuations tailored to your needs.

About the Author

Jéferson Silveira Martins is a specialist in mergers and acquisitions (M&A), business development, and investment fundraising in the agribusiness and mining sectors. As the founder of Silveira Capital, he leads strategic transactions, connecting investors with solid opportunities.

Learn more about Jéferson Silveira Martins and his career here: Jéferson Silveira Martins Bio

Legal Disclaimer:

The information provided in this article is for informational and educational purposes only. It does not constitute financial, legal, or accounting advice and should not be used as a substitute for consultation with qualified professionals. Silveira Capital assumes no responsibility for any decisions made based on the information contained in this article. We recommend seeking personalized professional guidance before making decisions related to business valuation or financial transactions.